With passenger traffic growing by 8.1% in the fourth quarter, Target, a US supermarket chain, achieved comparable sales growth for the 19th consecutive quarter.

At an investor meeting, Target CEO Brian Cornell (Brian Cornell) cited the company’s growth and other data points as evidence that “our strategy is working.”

In the fourth quarter, Target’s comparable sales grew by 8.9%, up from more than 20% the previous year.

For the whole fiscal year, comparable sales increased by 12.7%, up 12.3% from 19.3% the previous year, and comparable passenger traffic increased by 12.3%.

Target’s revenue rose 36.8 per cent to $8.9 billion for the full year, even as rising costs for freight, goods and supply chains eroded profit margins.

Brian Cornell pointed out that Target’s compound sales and profits began to grow before the COVID-19 epidemic and have continued to this day.

He believes that Target’s success among today’s shoppers is a direct result of Target’s continued investment in physical stores and digital capabilities, which investors were skeptical when Target first launched its investment plan about five years ago.

Target has also shown that thanks to its financial and resource scale, Target can cope with extensive supply chain disruptions over the past year or so.

Gross profit margin fell by about 1 percentage point in the fourth quarter due to supply chain costs, that is, increased wages and employees in distribution centres, as well as higher freight and sales costs.

However, Target’s operating margin rose from 6.5 per cent to 6.8 per cent year-on-year, driven by sales growth.

A similar situation occurred for the whole of 2021, with gross profit margins slightly lower than in 2020, but operating revenue increased by $2.4 billion over the same period.

The increase in supply chain and operating costs is largely offset by a more optimized mix of product categories and lower price cuts, which are one of the few advantages of a tight inventory environment in retailing in 2021.

One of the keys to Target’s sales growth is its brick-and-mortar stores, which are driven by increased passenger traffic.

Here, Brian Cornell points out once again the initial doubts about Target’s decision to invest billions of dollars in its stores, when many retailers were in a reasonable mode of sizing and layoffs to prepare for the future of deeper digital shopping.

“the retail trend at the time was to close stores, not to increase the number of stores,” Cornell said of the situation.

In addition, Target’s brick-and-mortar stores act as distribution centers, and 95% of its fourth-quarter sales are done by its stores in some way.

The omni-channel model based on brick-and-mortar stores brings a lot of business to Target again during the autumn and winter holidays.

Neil Saunders, managing director of GlobalData, said in an email comment that Target’s omni-channel service was “seen by consumers as highly reliable, while Target’s very solid holiday gifts and decorations drive many shoppers into the store, many of whom buy on impulse”.

“the end result of all this is that Target has increased spending on existing customers and attracted some new customers,” Sanders added.

Target’s same-day arrival service and its status as an one-stop shop made it the preferred shopping destination for customers during COVID-19 ‘s epidemic.

“Target won millions of new customers during COVID-19 ‘s epidemic, and combined with deeper relationships with existing customers, the company is constantly gaining new market share and strong growth,” said Telsey Advisory Group analysts led by Joe Feldman.

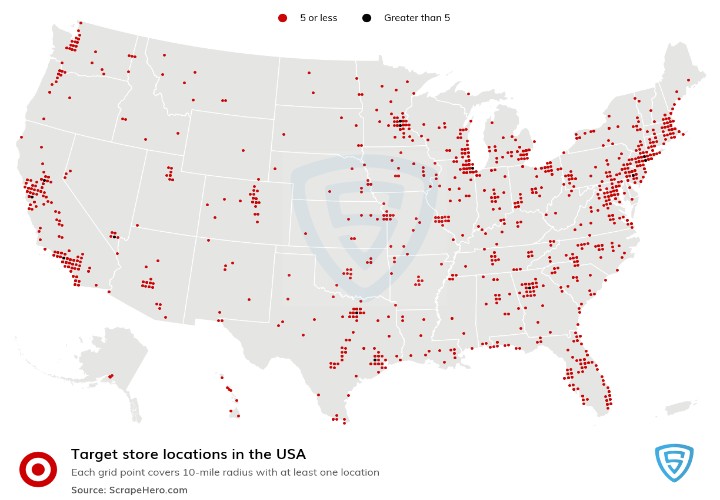

In order to take advantage of the victory, Target has recently planned a $5 billion operating investment, including the opening of 30 new stores to enter the new regional market.

The new locations include medium-sized shops in the suburbs and small shops in the heart of cities such as Charleston, South Carolina and Times Square, New York.

In addition to the new stores, Target announced plans for a “top-down renovation” of 200 existing stores and plans to open more than 250 Ulta stores by the end of 2022.

All of these moves are part of Target’s plan to invest $5 billion to expand its business this year.

The retailer’s investment plan also includes investments in its figures, performance and distribution capabilities.

Target expects moderate single-digit growth in revenue and operating profit over the next few years, with a 30 per cent return on investment capital.